Lecture 11

Announcements

- Assignment 4 posted

Last time

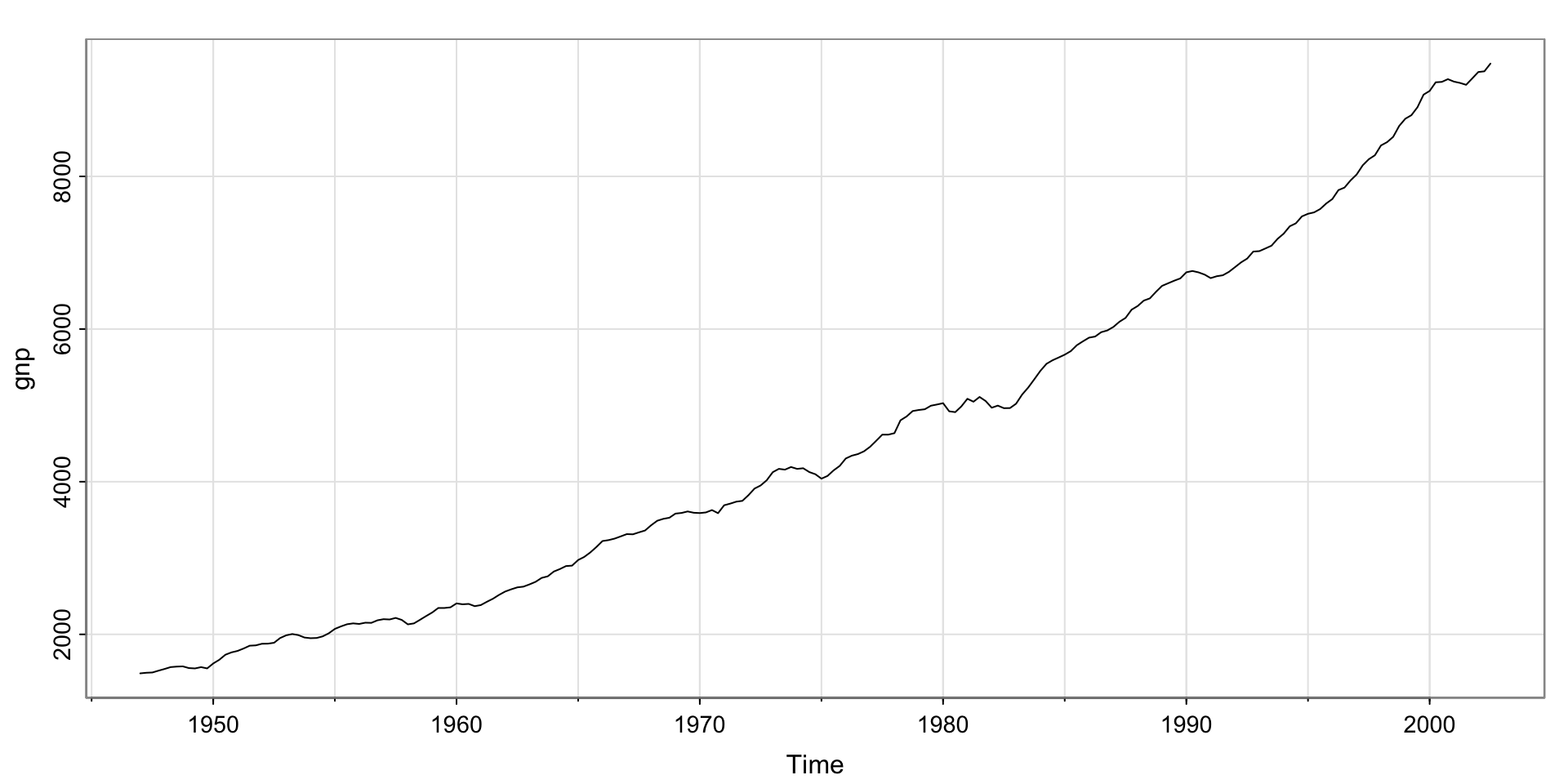

U.S. GNP data– clearly has a trend, nonstationary

Is the trend linear?

Not exactly…

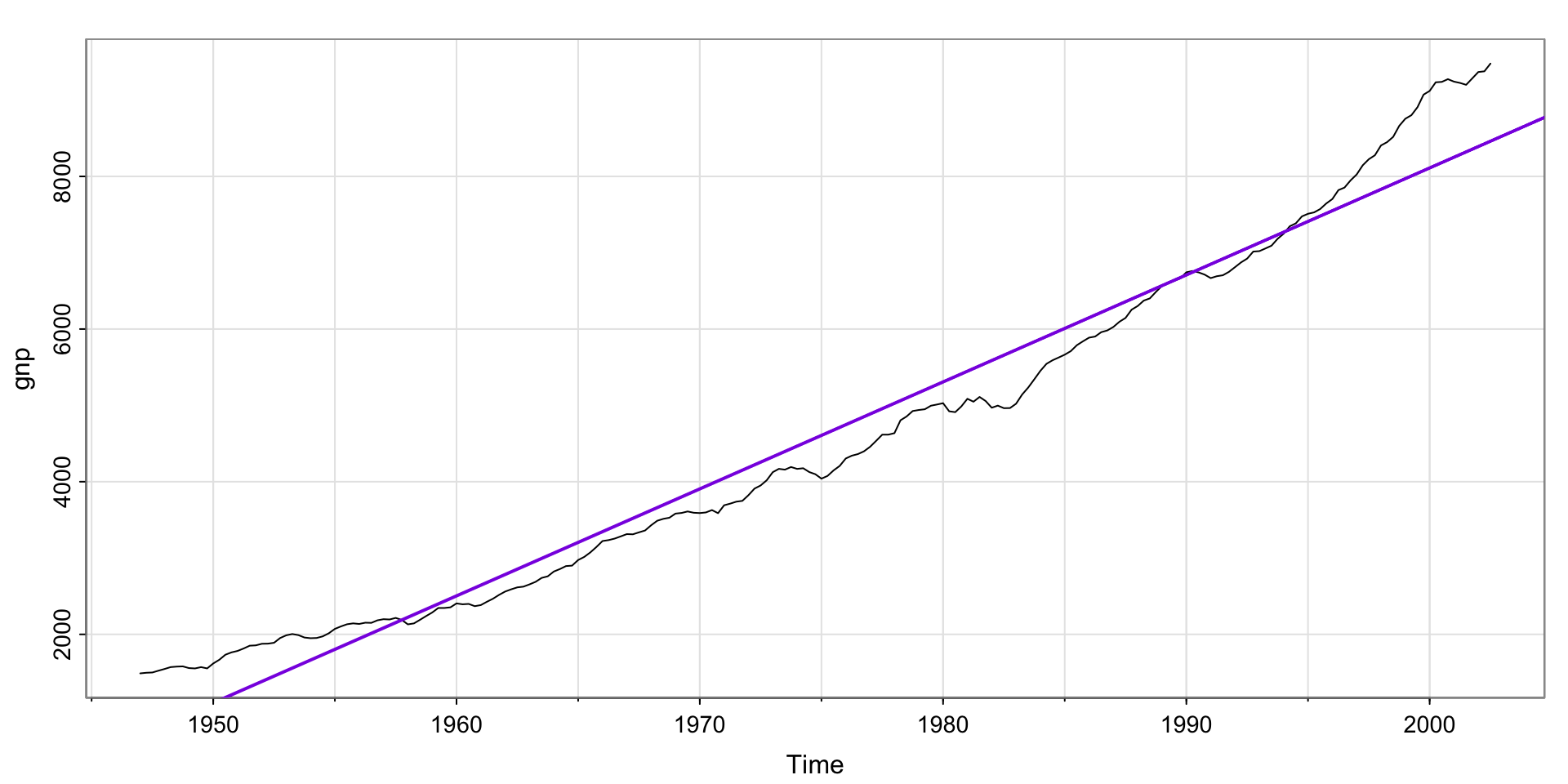

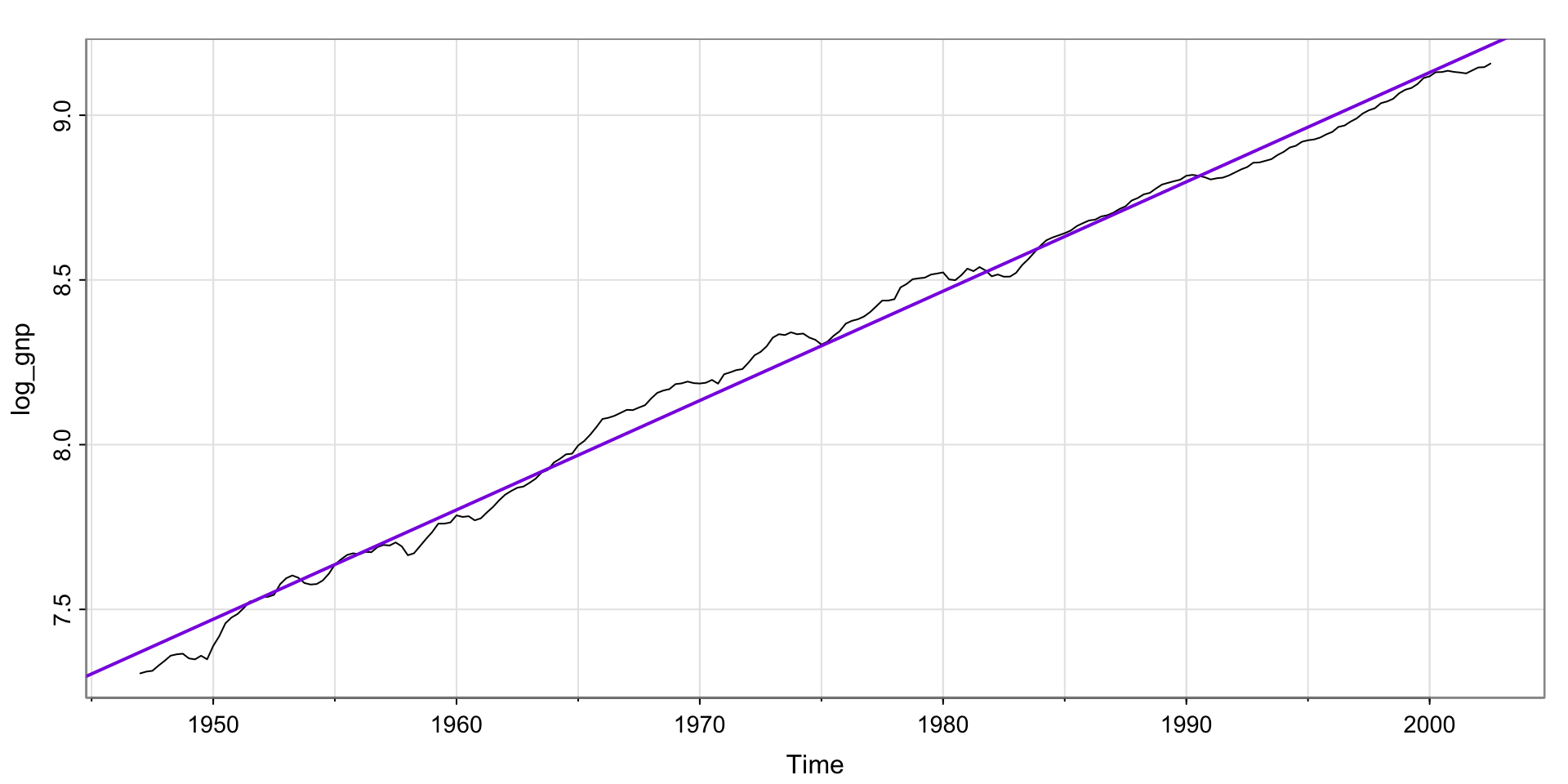

Try taking the log?

Much better! But, still not stationary.

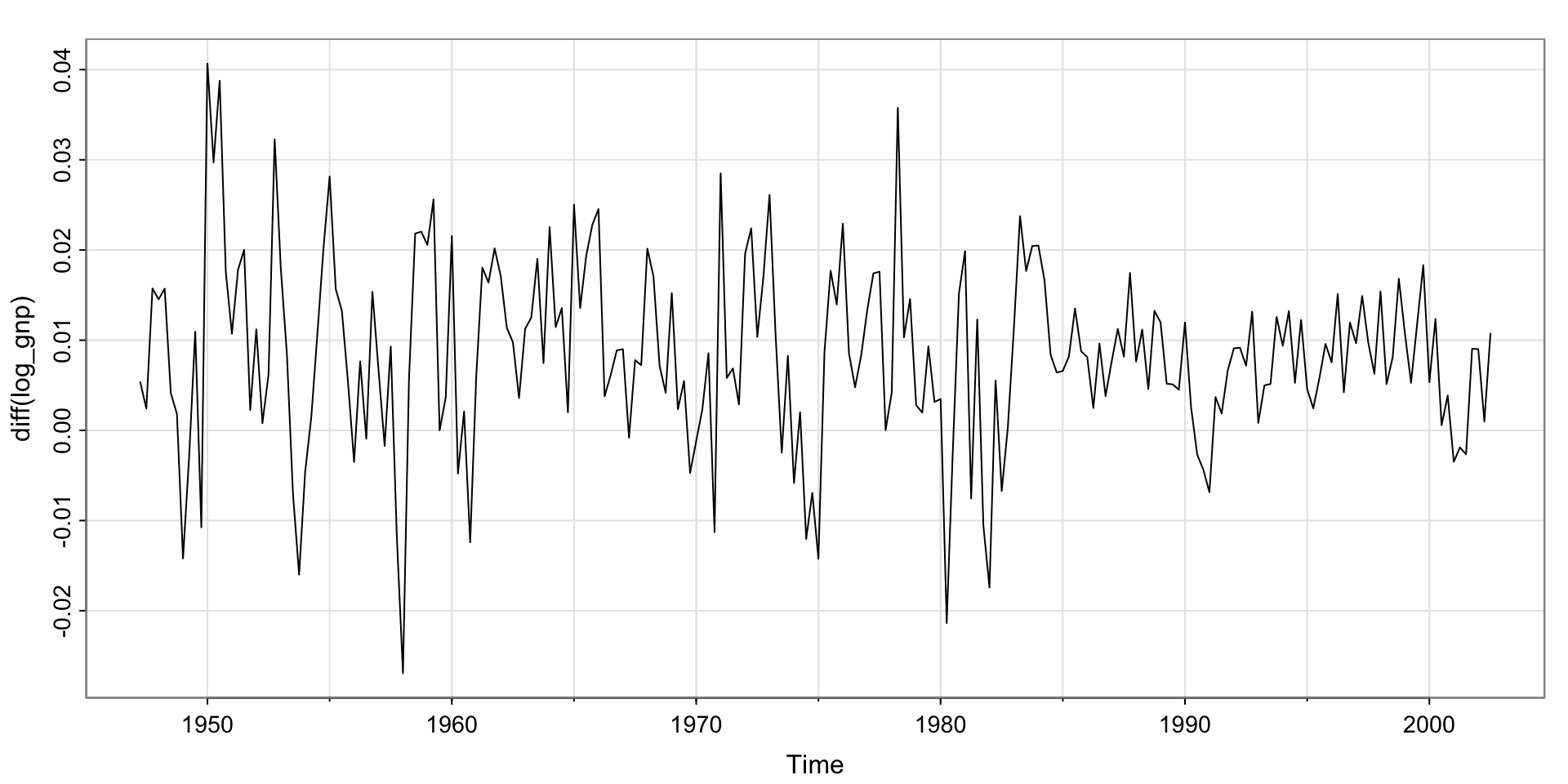

Try differencing?

Is this stationary? No? Yes? Maybe there’s a bit of a trend?

Unit root tests

Augmented Dickey-Fuller (ADF)

Null hypothesis: random walk (nonstationary)

Alternative hypothesis: stationary data

Kwiatkowski-Phillips-Schmidt-Shin (KPSS)

Null hypothesis: stationary data

Alternative hypothesis: nonstationary data

What’s a unit?

1 (one)

What’s a root of a polynomial?

Example:Find the roots of \(1 - Ax + Bx^2 = 0\)

Use the quadratic formula:

\[ x = \frac{A \pm \sqrt{A^2 - 4B }}{2B} \] A unit root would be where \(x = 1\) is a solution.

What do we care about being one?

For an AR(1),

\[ x_t = \phi x_{t-1} + w_t \]

If \(\phi = 1\), we have a random walk (nonstationary). We’d like a hypothesis test that is able to use information about plausible values of \(\phi\) so that we can see if 1 is plausible.

Wait, where’s the polynomial? (Advanced topic)

It’s the AR polynomial– the polynomial with respect to the lag operator. If the AR polynomial has a unit root, the data are nonstationary.

But since it corresponds to having \(\phi = 1\), we can derive the distribution of our estimate of \(\phi\), \(\widehat{\phi}\), and use reasonable distributional assumptions so that we can calculate a p-value. If the roots are less than or equal to 1, that’s nonstationary.

Unit root test in R using features function

# A tibble: 1 × 2

kpss_stat kpss_pvalue

<dbl> <dbl>

1 0.141 0.1Since the p-value is not very small, we fail to reject the null hypothesis that the data is stationary.

Activity 0

In practice

Use the unitroot_ndiffs() function to figure out how many differences you need.

Recall the ARIMA modeling workflow

Activity 1: Manual analysis

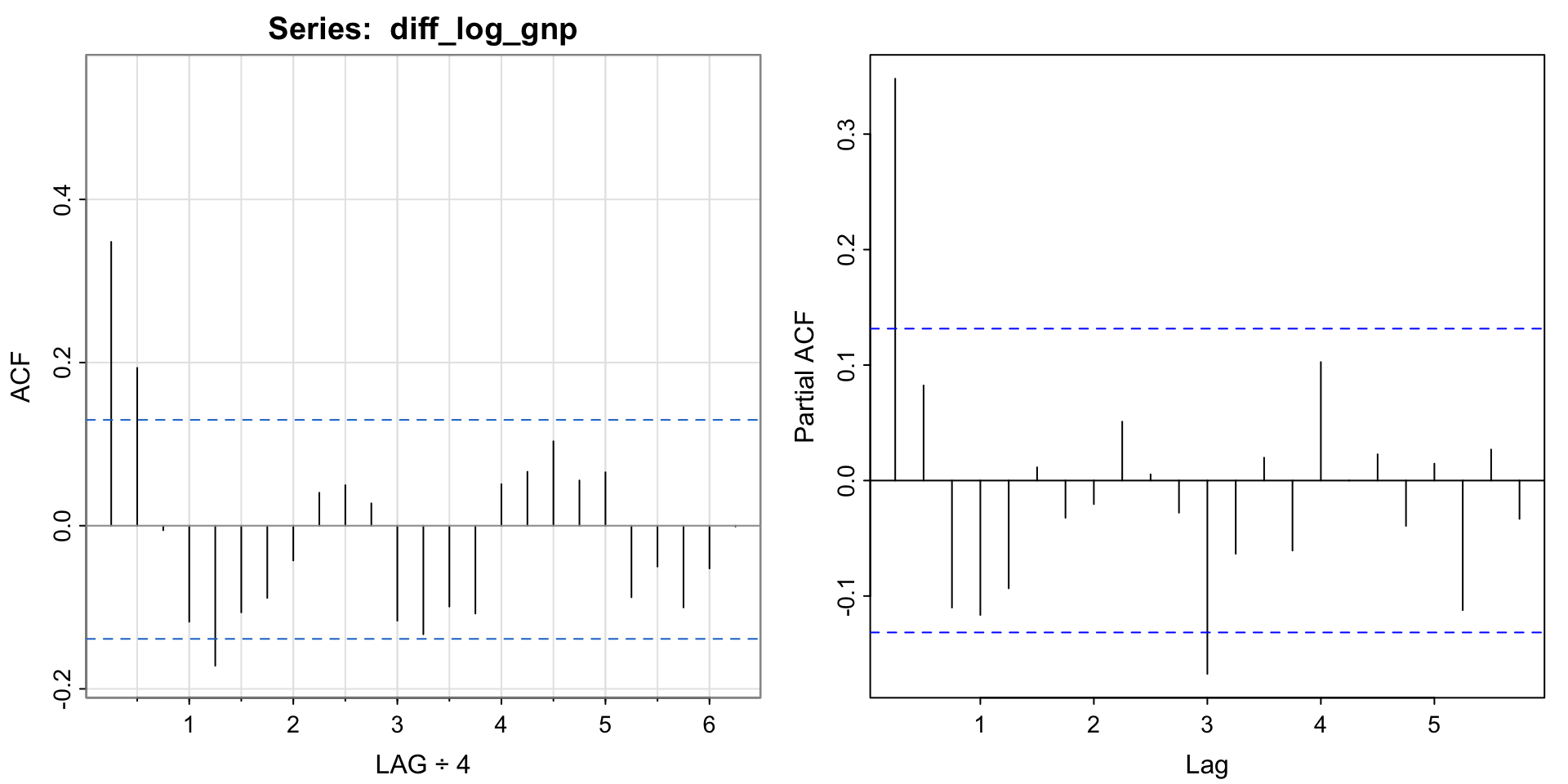

Find the order of the ARMA(p,q) process for the log differenced GNP.

Check the residuals

Activity 1 Solutions (manual)

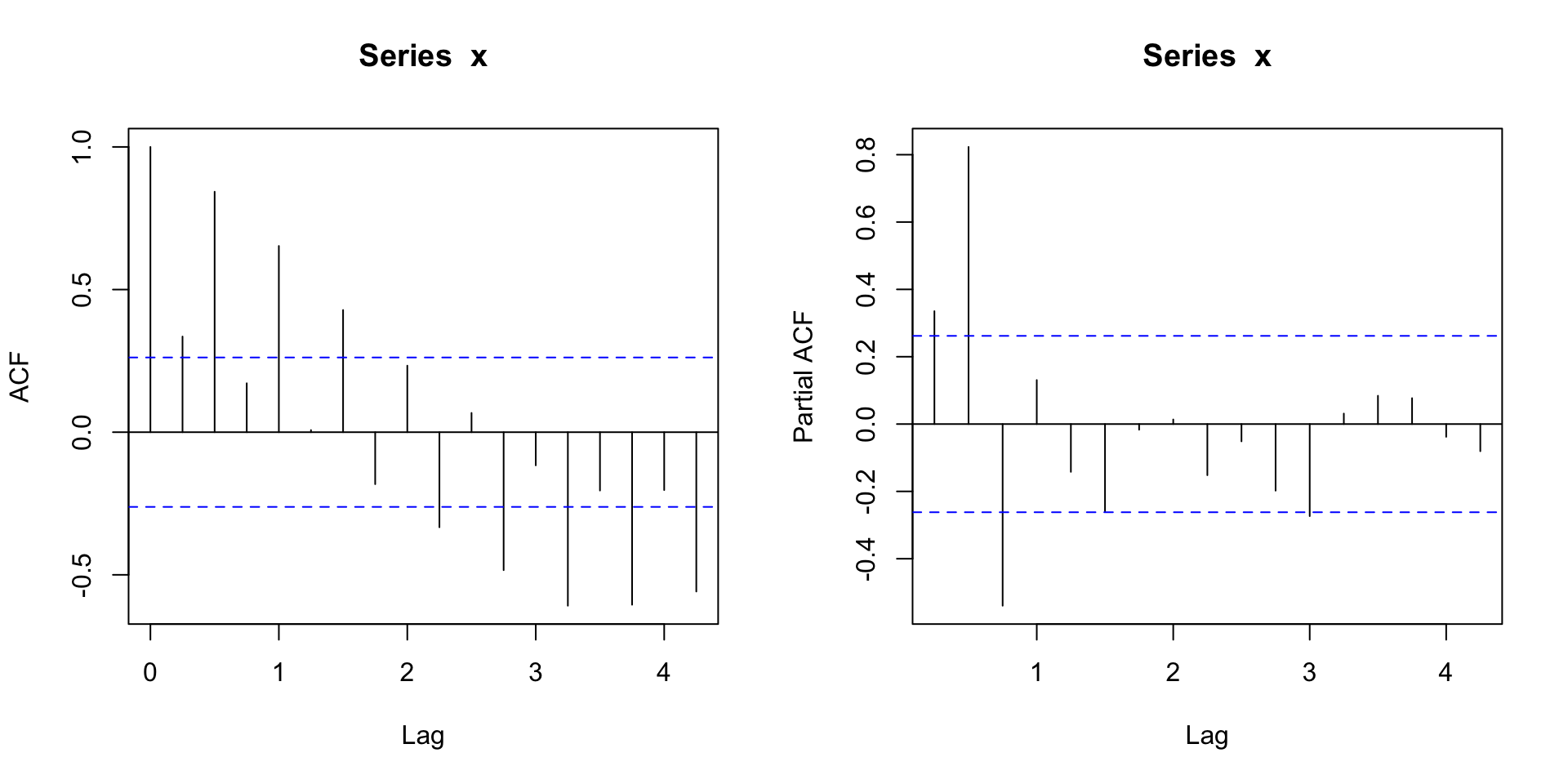

Manual: look at ACF and PACF. The ACF maybe cuts at lag 2 and the PACF appears to tail off. So maybe MA(2)?

Code

[1] 0.35 0.19 -0.01 -0.12 -0.17 -0.11 -0.09 -0.04 0.04 0.05 0.03 -0.12

[13] -0.13 -0.10 -0.11 0.05 0.07 0.10 0.06 0.07 -0.09 -0.05 -0.10 -0.05

[25] 0.00

Handy table

| AR(p) | MA(q) | ARMA(p,q) | |

|---|---|---|---|

| ACF | Tails off | Cuts off after lag q | Tails off |

| PACF | Cuts off after lag p | Tails off | Tails off |

Activity 1 Solutions (manual)

Code

Series: value

Model: ARIMA(0,0,2) w/ mean

Coefficients:

ma1 ma2 constant

0.3028 0.2035 0.0083

s.e. 0.0654 0.0644 0.0010

sigma^2 estimated as 9.041e-05: log likelihood=719.96

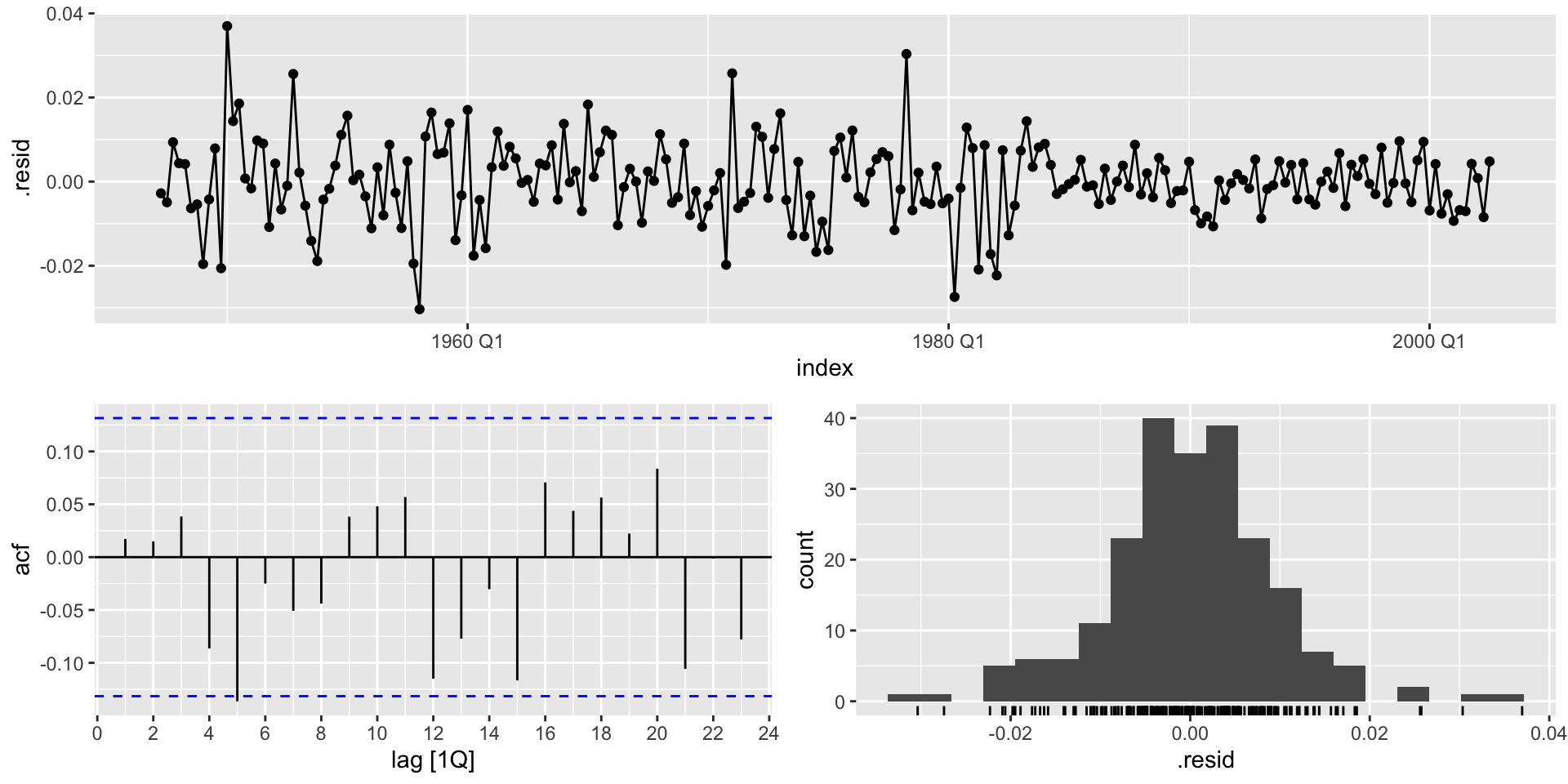

AIC=-1431.93 AICc=-1431.75 BIC=-1418.32Activity 1 Solutions

The residuals look like white noise

What about automatic?

Different answer– but, looking at the ACFS, kind of reasonable.

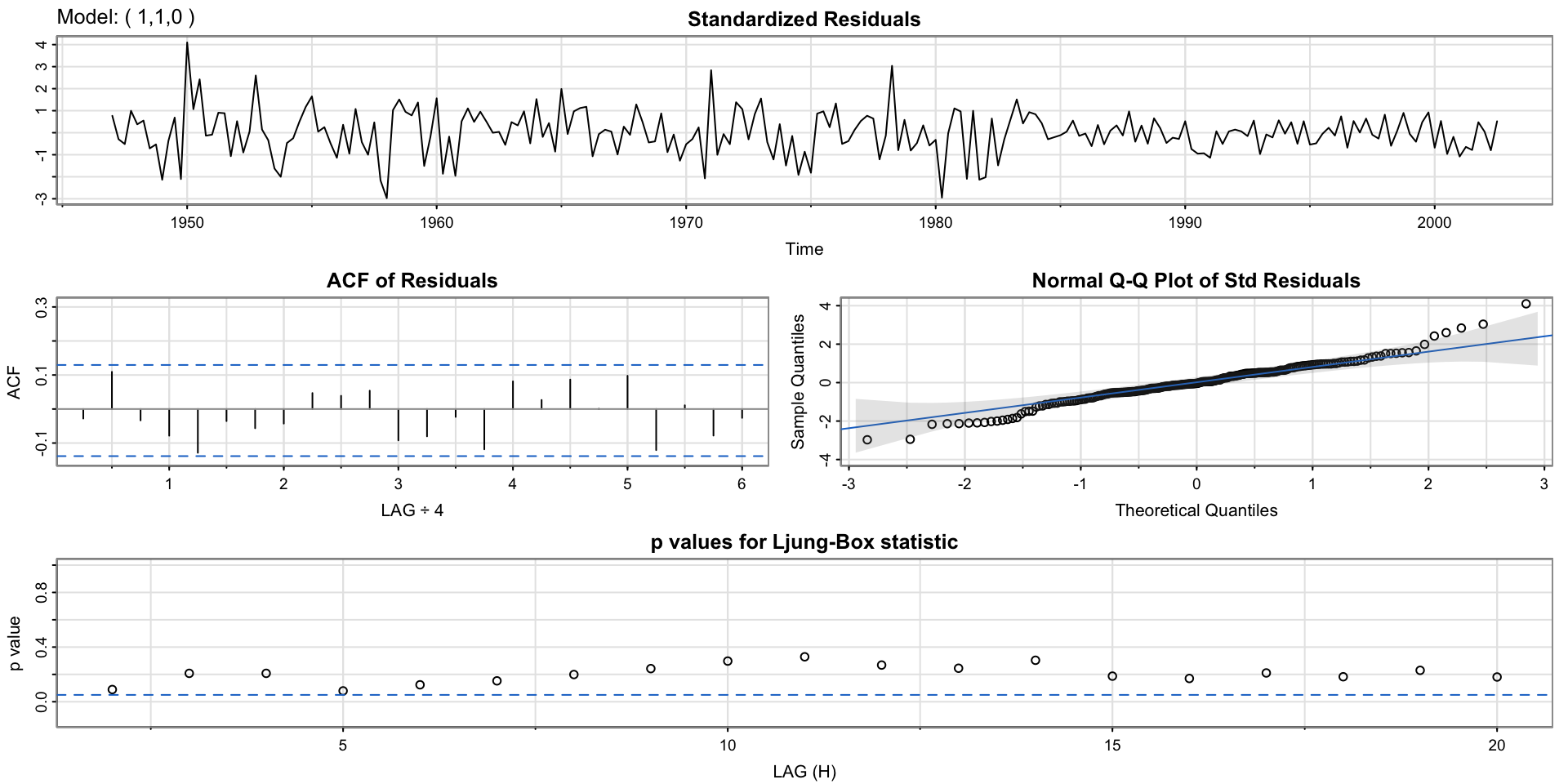

Specifying \(d\) in the ARIMA call

Work with the non-differenced data, and specify \(d =1\) in pdq(). We get the same estimated model.

Code

Series: value

Model: ARIMA(1,1,0) w/ drift

Coefficients:

ar1 constant

0.3467 0.0054

s.e. 0.0627 0.0006

sigma^2 estimated as 9.136e-05: log likelihood=718.61

AIC=-1431.22 AICc=-1431.11 BIC=-1421.01Going fully automated

Allow ARIMA to choose the order of the differencing \(d\) and \(p,q\).

Based on corrected AIC, this is slightly better than our model. But this model is quite complicated!

Code

Series: value

Model: ARIMA(3,1,1) w/ drift

Coefficients:

ar1 ar2 ar3 ma1 constant

1.0905 -0.1251 -0.1739 -0.7881 0.0017

s.e. 0.3027 0.1529 0.0777 0.3112 0.0001

sigma^2 estimated as 8.906e-05: log likelihood=722.89

AIC=-1433.78 AICc=-1433.39 BIC=-1413.36Activity 2: Should we go fully automated??

Go to the ASTSA package github and click “Estimation” under 4.ARIMA

Read between the watermelon 🍉 and alien 👽

Are they using the

ARIMAfunction? Is the function they are using different?Explain how the code under “DON’T BELIEVE IT?? OK… HERE YOU GO” provides evidence that automatic arima functions don’t work

Using the sarima function for diagnostics

initial value -4.589567

iter 2 value -4.654150

iter 3 value -4.654150

iter 4 value -4.654151

iter 4 value -4.654151

iter 4 value -4.654151

final value -4.654151

converged

initial value -4.655919

iter 2 value -4.655921

iter 3 value -4.655921

iter 4 value -4.655922

iter 5 value -4.655922

iter 5 value -4.655922

iter 5 value -4.655922

final value -4.655922

converged

<><><><><><><><><><><><><><>

Coefficients:

Estimate SE t.value p.value

ar1 0.3467 0.0627 5.5255 0

constant 0.0083 0.0010 8.5398 0

sigma^2 estimated as 9.029576e-05 on 220 degrees of freedom

AIC = -6.446939 AICc = -6.446692 BIC = -6.400957

Activity 3: p-values for Ljung-Box statistic

When an R function for fitting a model gives you a diagnostic plot by default, it’s good to understand that plot– it’s probably useful!

Use whatever resources you can to figure out what that bottom plot means

Testing if the residuals are white noise

Portmanteau tests (French for suitcase or coat rack carrying several items of clothing) (do the residuals “carry information”

Null hypothesis: Residuals are generated by a white noise process.

Alternative hypothesis: Residuals are not generated by a white noise process.

Lots of options for tests, we will use Ljung-Box (default output)

Ljung-box in fable

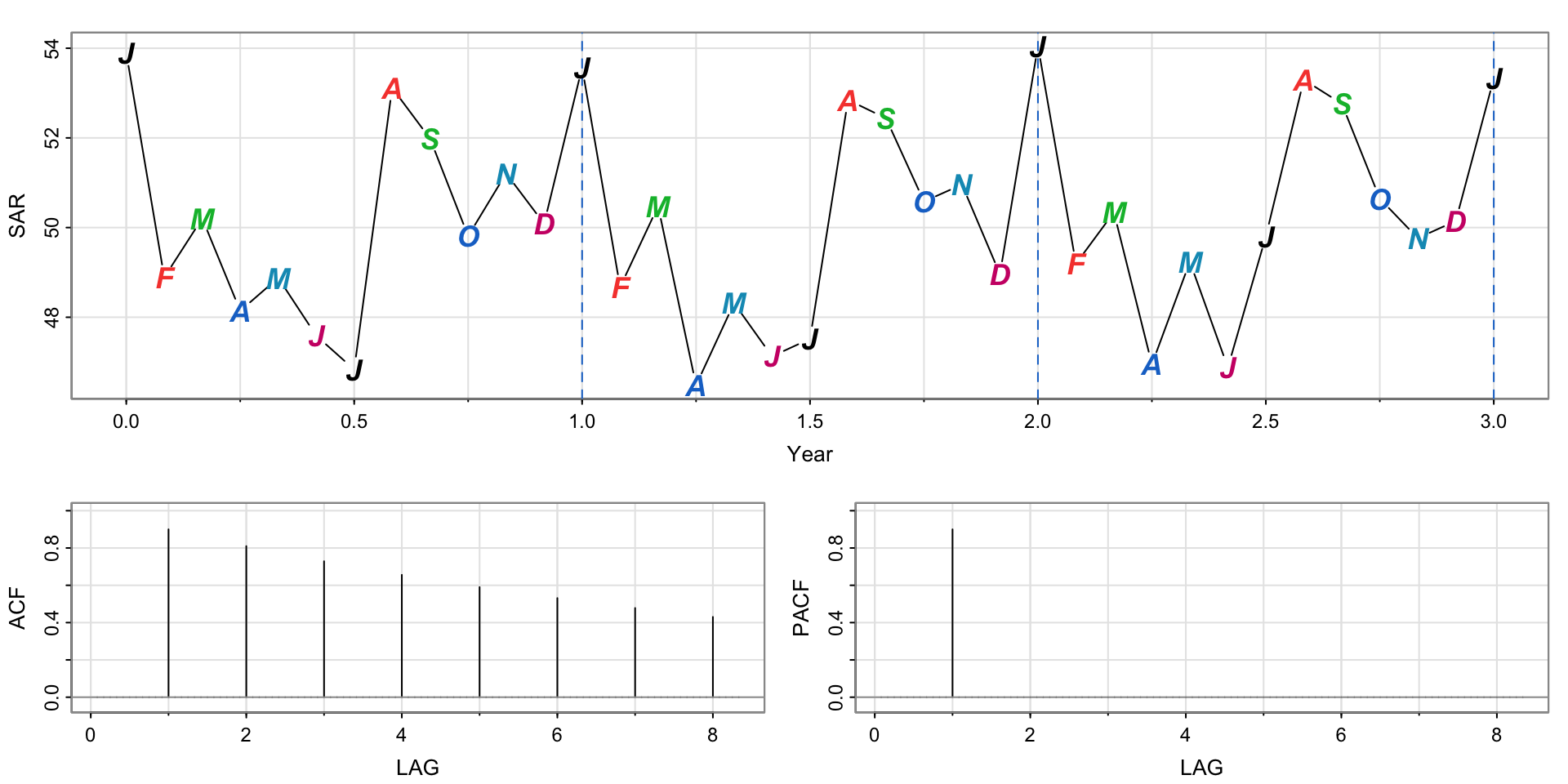

Seasonal Arima models

Goal: define Seasonal Arima model

Want:

\[ ARIMA(p, d, q)\times(P,D,Q)_{S} \]

first part is the same as before– nonseasonal

second part is similar to before, but we interpret lags as having a seasonal period.

Pure Seasonal ARIMA

A time series \(x_t\) is said to follow a Pure Seasonal ARIMA model, with parameters \(P, D, Q\), and seasonal period \(S\) (or \(T\)), if

\(x_t\) has a seasonal component with period \(S\)

is ARIMA(P,D,Q) where we interpret the lag as a seasonal lag, i.e. lagging by \(S\)

Simulating a pure seasonal AR(1) process

Notice the peaks every January– the seasonal period here is 12 (or 1 if we divide by 12).

The same “tailing off”/“cutting off” behavior is the same, but we look for seasonal spikes

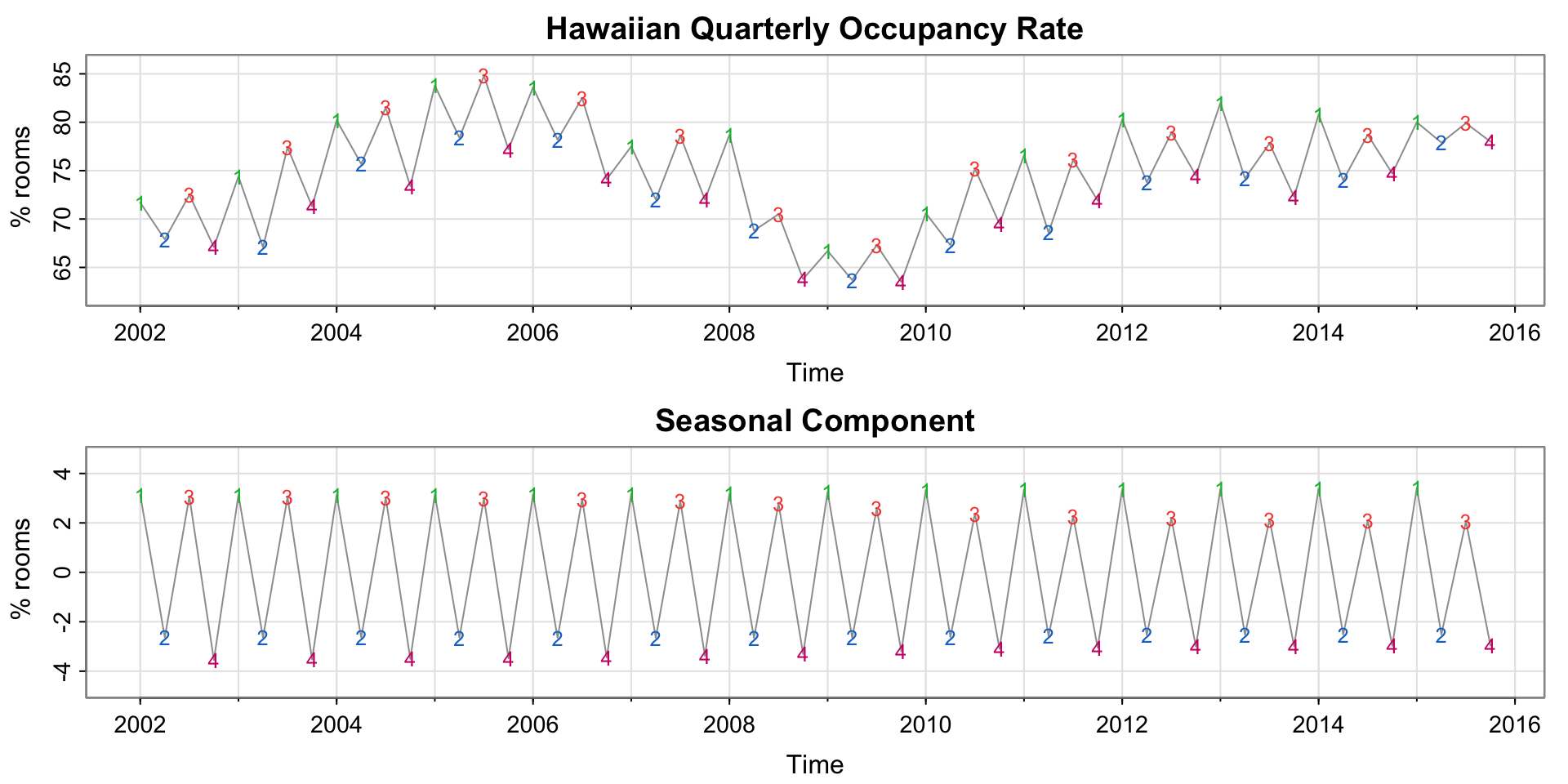

Hawaiian Quarterly Occupancy

The two plots show the time series, and the extracted seasonal component.

Hawaiian Quarterly Occupancy

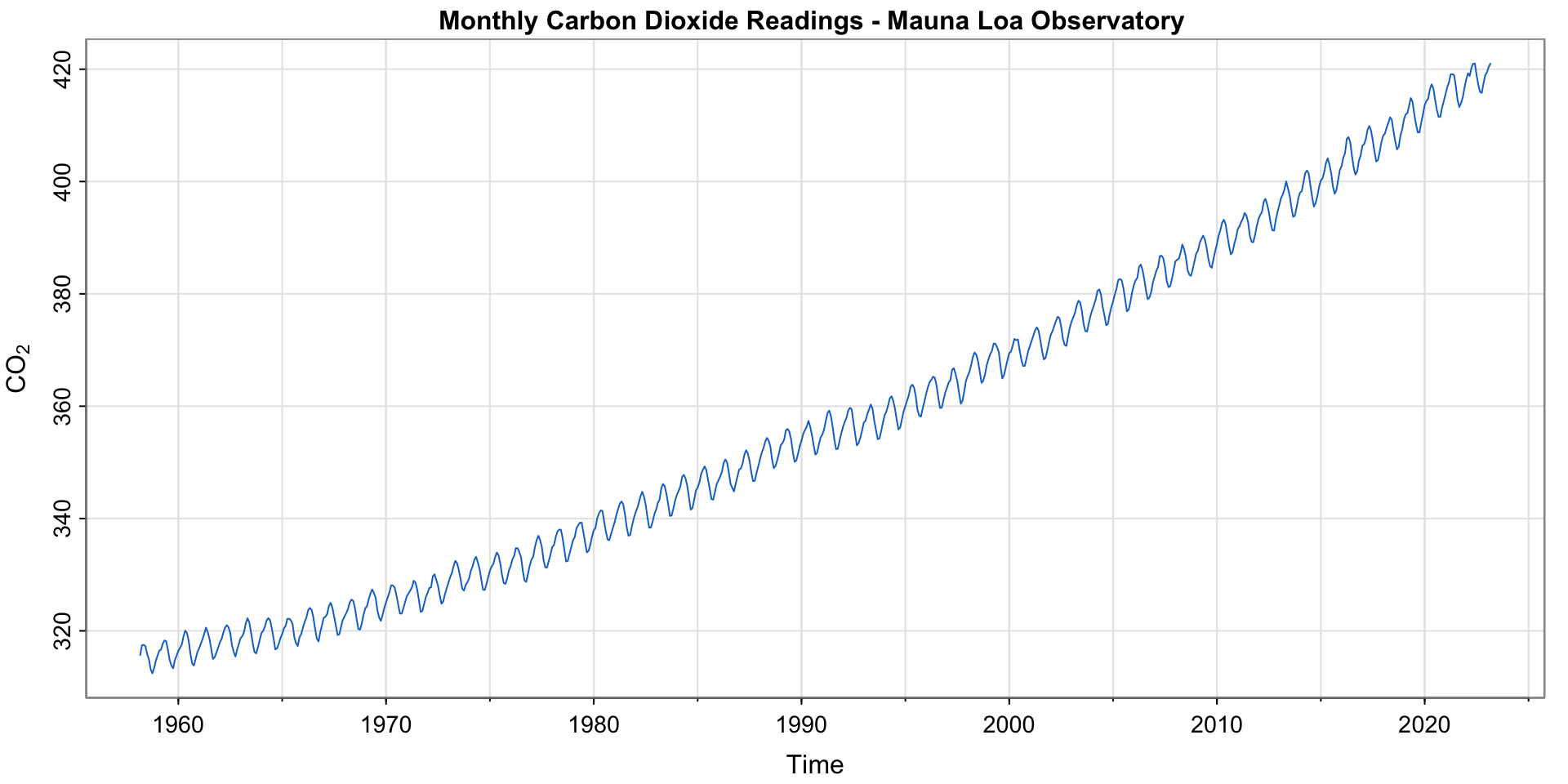

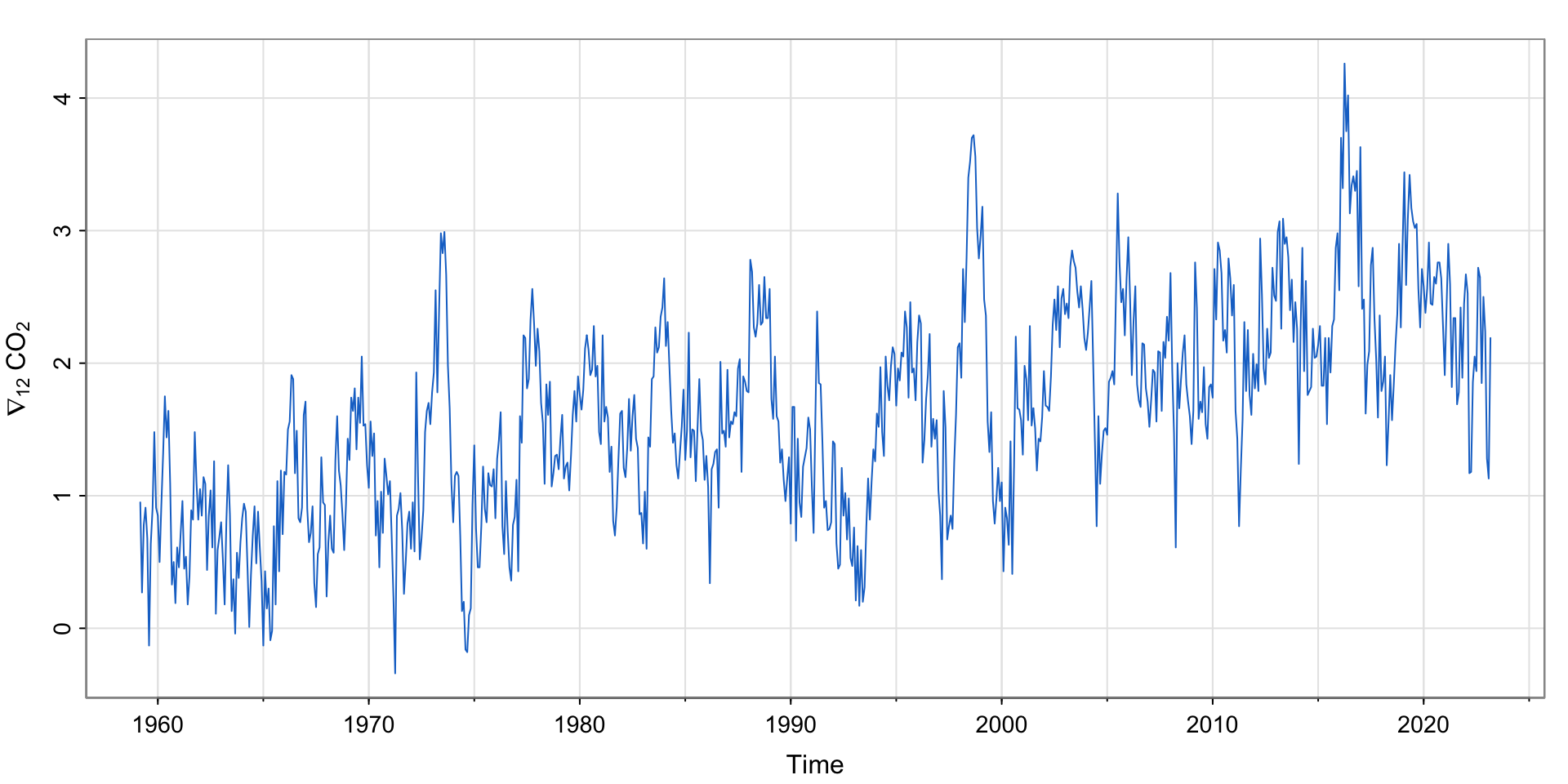

Carbon Dioxide Readings

Monthly \(CO_2\) readings at Mauna Loa Observatory

Do we see a seasonal pattern?

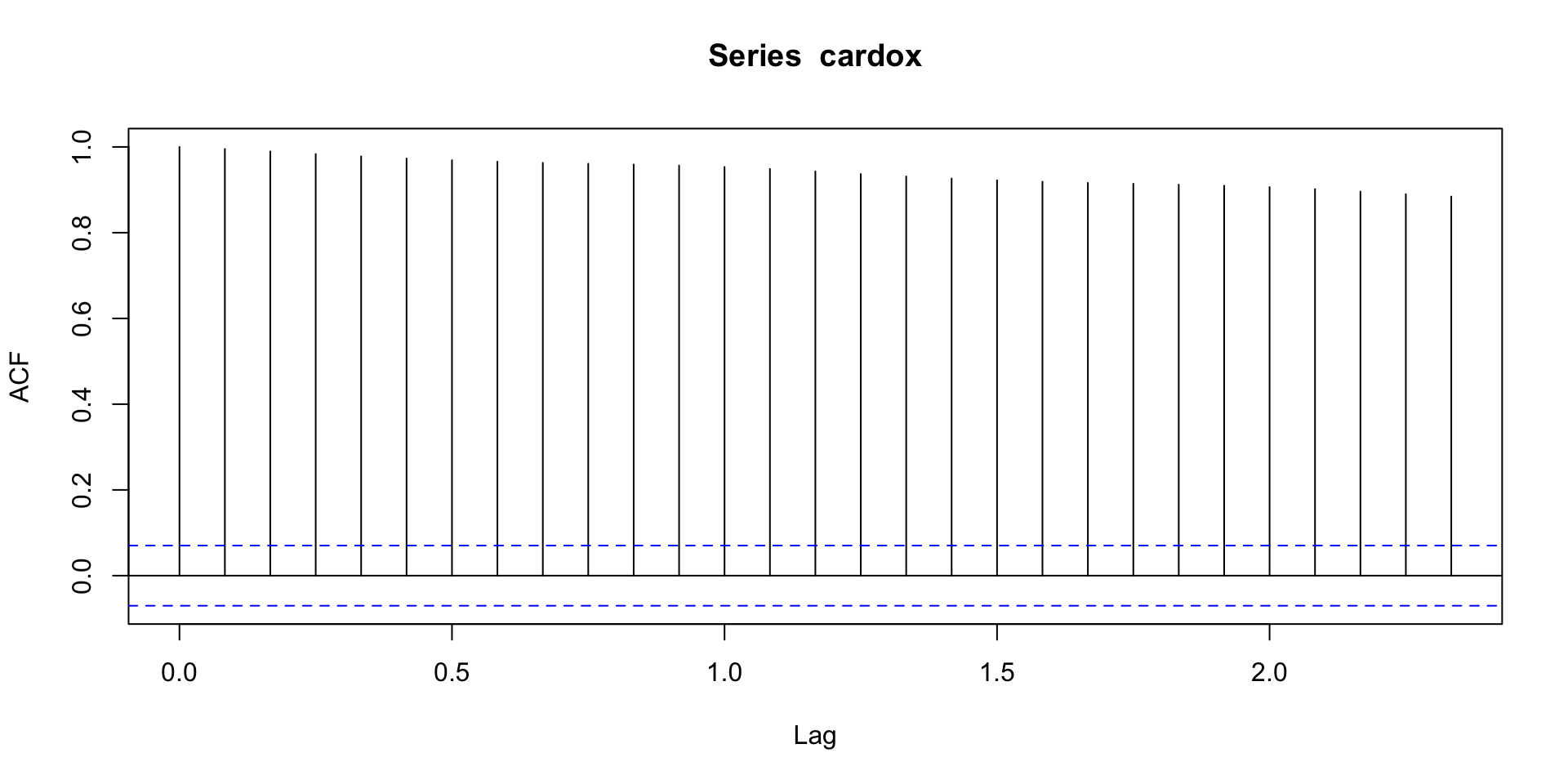

What’s the acf?

Let’s try a seasonal difference!

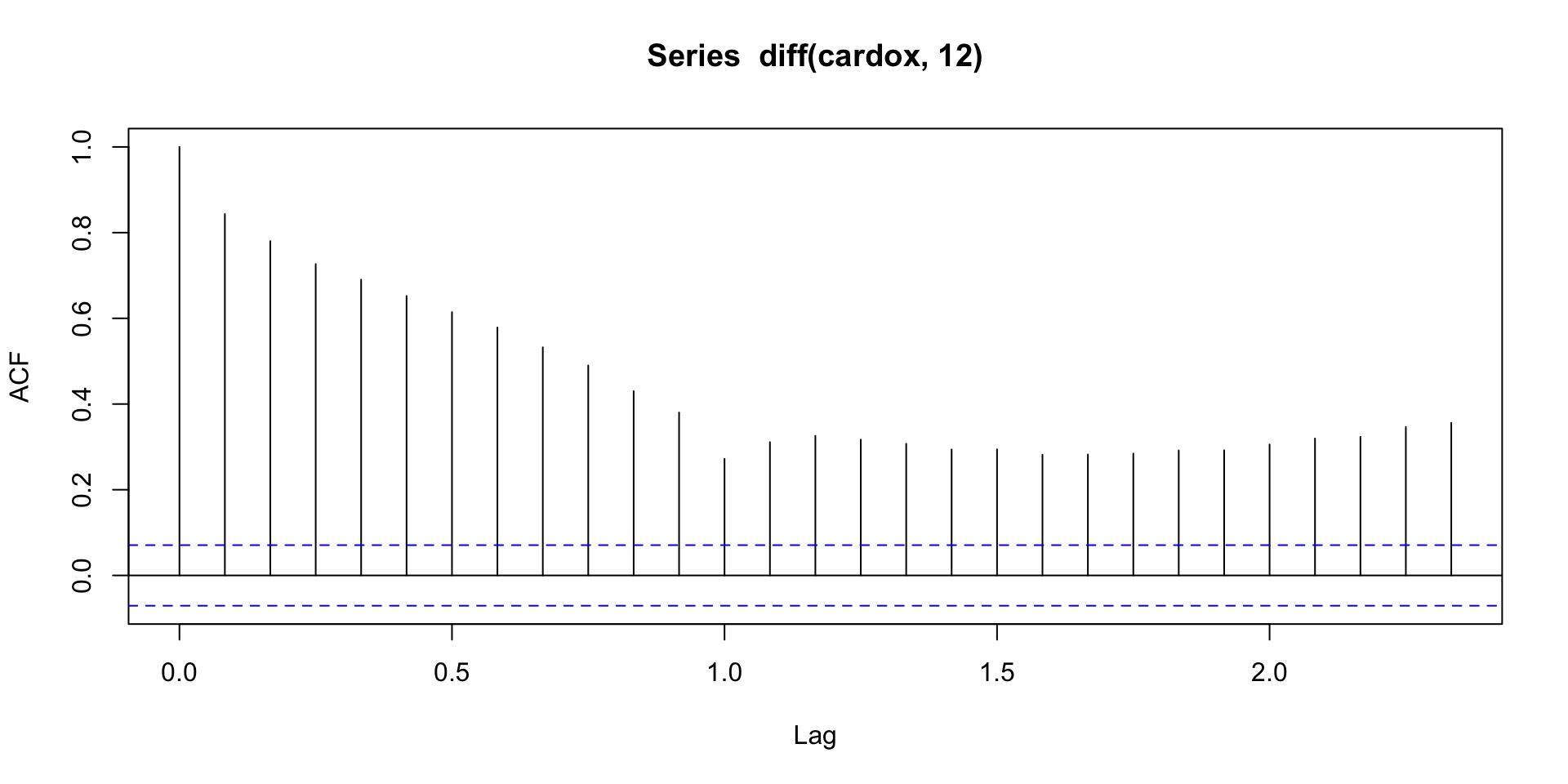

Check the acf

Still a trend..difference again?

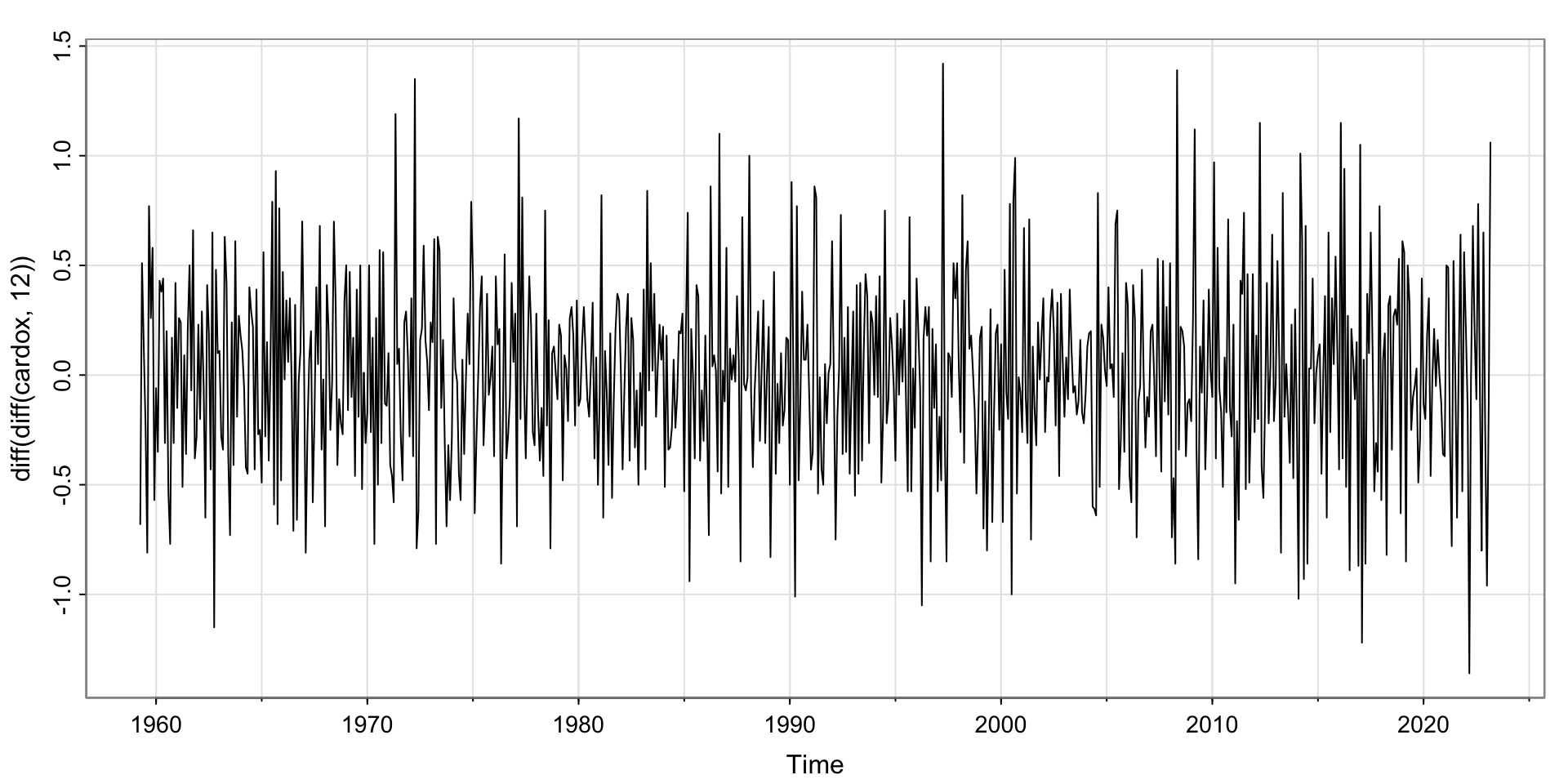

Difference and Seasonal Difference

Looks pretty stationary!

Finding \(p,q\) and \(P,Q\)

We have identified \(d = 1\) and \(D=1\).

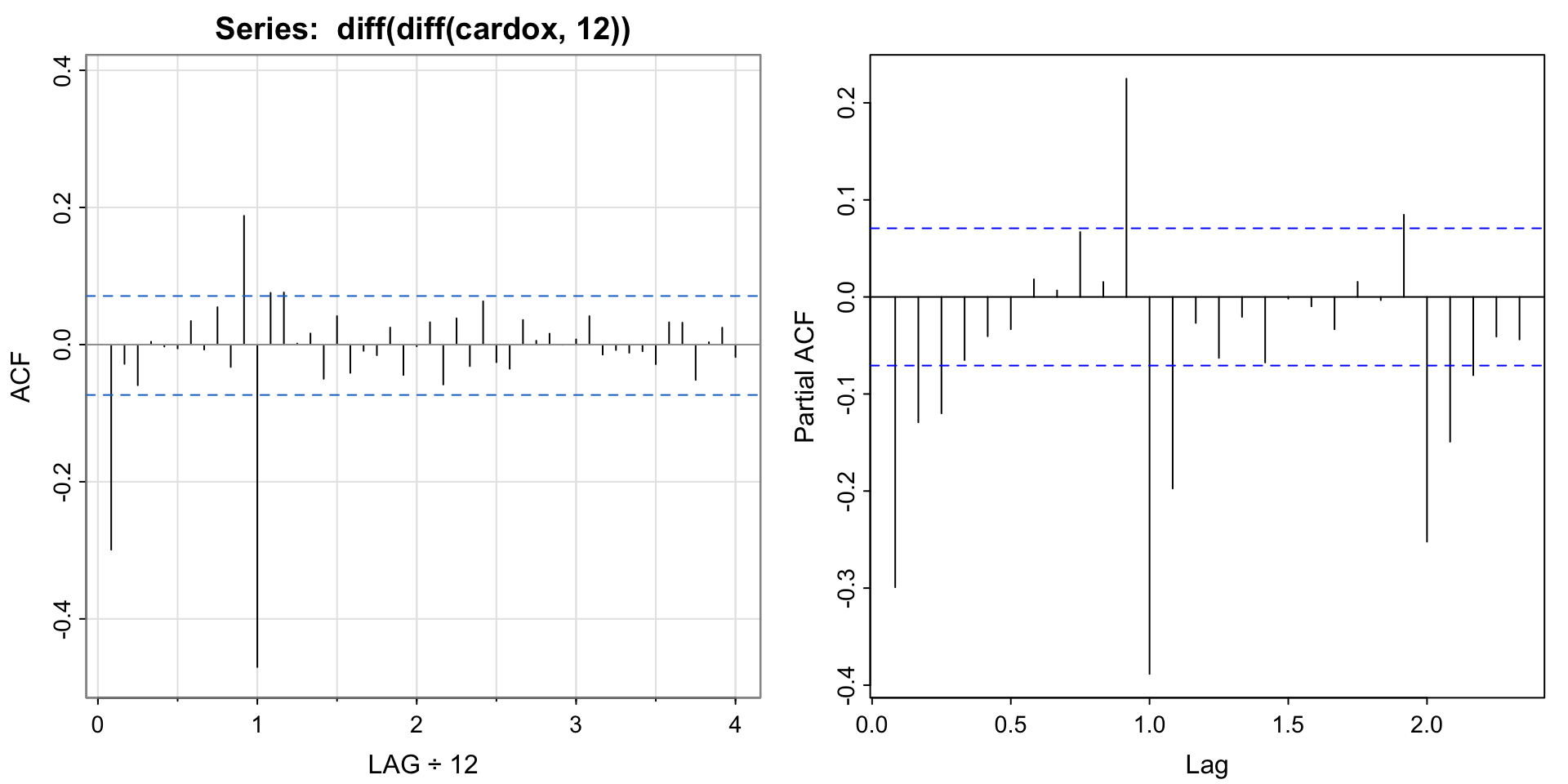

SEASONAL: Check acf/pacf for \(P,Q\) and recall the seasonal period (here 12/12 = 1)

NON-SEASONAL: Check acf/pacf for \(p,q\) just like before.

\(p,q\) and \(P,Q\) for Carbon Dioxide

Seasonal: ACF appears to cut off at lag 1 (12 months), but tails of at lags 1, 2, 3, 4– implies a seasonal moving average, so \(Q=1, P= 0\).

Non-seasonal: Appears to cut off at lag 1 (1/12) and PACF tails off. Looks like a MA(1), so \(q = 1, p = 0\).

[1] -0.30 -0.03 -0.06 0.00 0.00 -0.01 0.03 -0.01 0.05 -0.03 0.19 -0.47

[13] 0.08 0.08 0.00 0.02 -0.05 0.04 -0.04 -0.01 -0.02 0.02 -0.04 0.00

[25] 0.03 -0.06 0.04 -0.03 0.06 -0.03 -0.04 0.04 0.01 0.02 0.00 0.01

[37] 0.04 -0.01 -0.01 -0.01 -0.01 -0.03 0.03 0.03 -0.05 0.00 0.02 -0.02

Fit \(ARIMA(0,1,1)\times(0,1,1)_{12}\)

initial value -0.826338

iter 2 value -1.059073

iter 3 value -1.093845

iter 4 value -1.116555

iter 5 value -1.124382

iter 6 value -1.126345

iter 7 value -1.127354

iter 8 value -1.127953

iter 9 value -1.127984

iter 10 value -1.127985

iter 10 value -1.127985

iter 10 value -1.127985

final value -1.127985

converged

initial value -1.144615

iter 2 value -1.148048

iter 3 value -1.148645

iter 4 value -1.149895

iter 5 value -1.150013

iter 6 value -1.150021

iter 7 value -1.150021

iter 7 value -1.150021

iter 7 value -1.150021

final value -1.150021

converged

<><><><><><><><><><><><><><>

Coefficients:

Estimate SE t.value p.value

ma1 -0.3869 0.0377 -10.2624 0

sma1 -0.8655 0.0183 -47.2846 0

sigma^2 estimated as 0.0980908 on 766 degrees of freedom

AIC = 0.5456475 AICc = 0.545668 BIC = 0.5637873

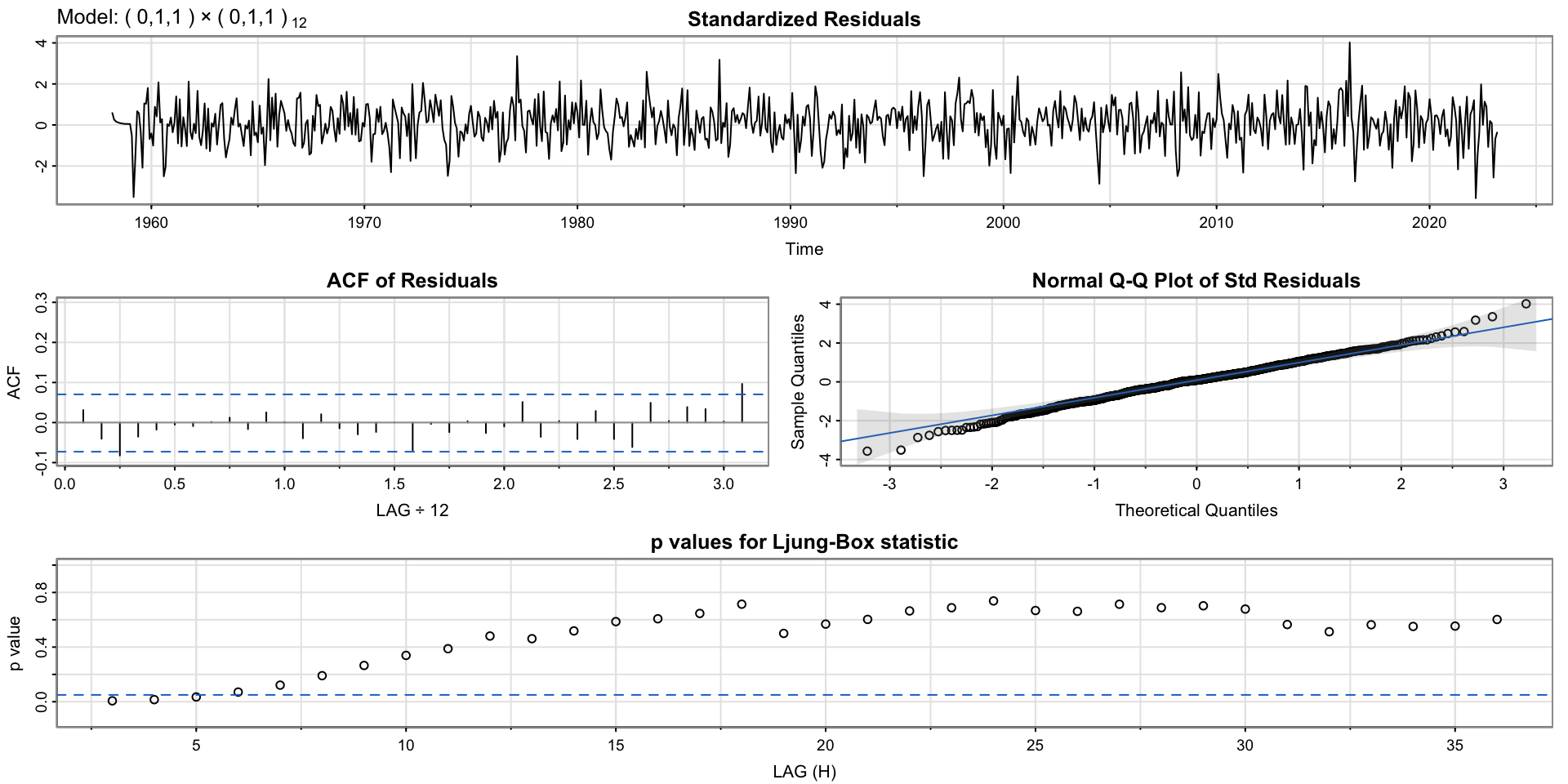

Results

may still have some residual autocorrelation (Ljung-box test for small lags)

Try adding another term? maybe increase order of MA or add AR component?

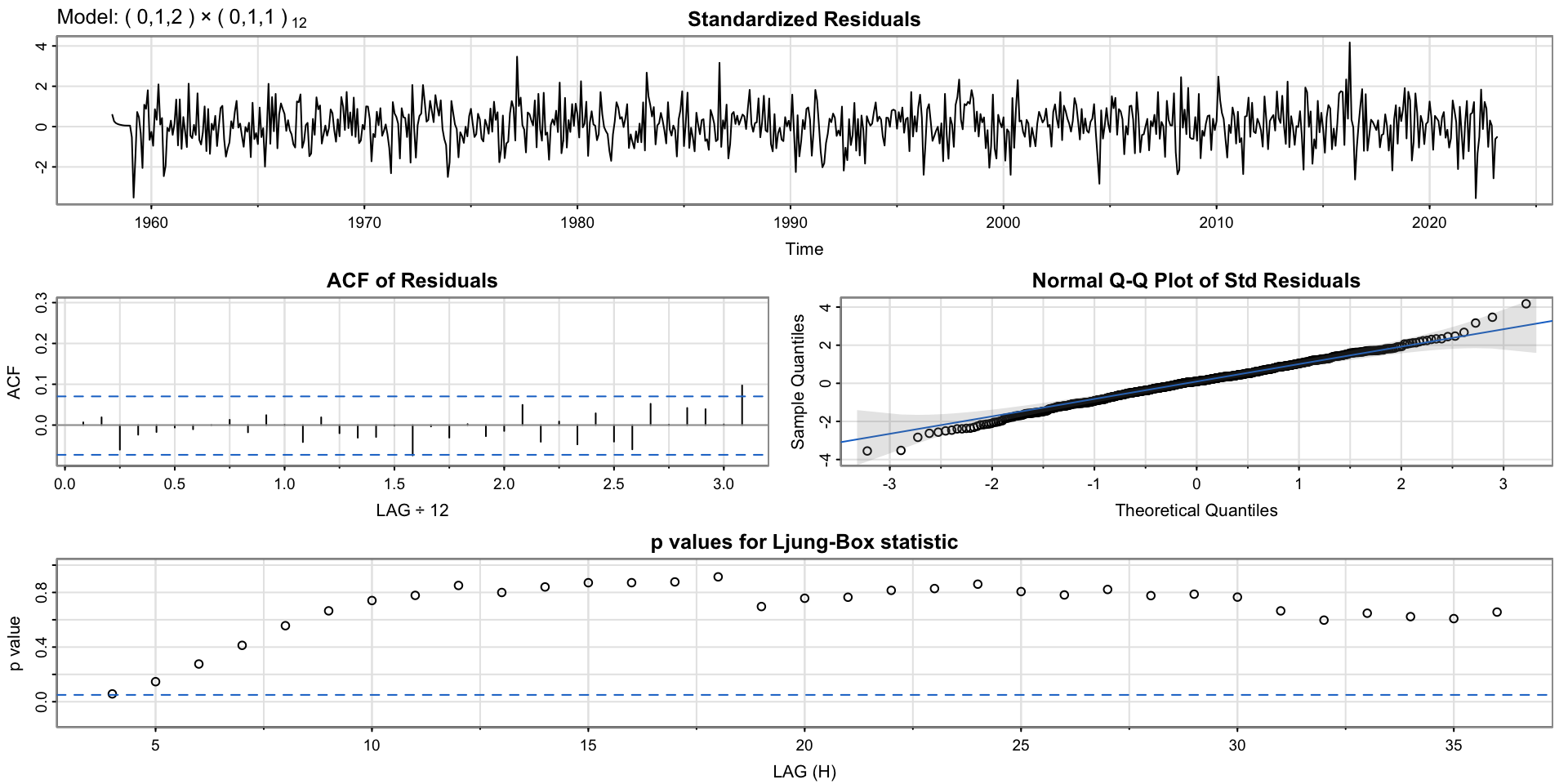

Increase order of MA

initial value -0.826338

iter 2 value -1.061232

iter 3 value -1.098226

iter 4 value -1.120391

iter 5 value -1.127720

iter 6 value -1.129516

iter 7 value -1.130690

iter 8 value -1.130938

iter 9 value -1.130955

iter 10 value -1.130959

iter 11 value -1.130959

iter 12 value -1.130959

iter 12 value -1.130959

iter 12 value -1.130959

final value -1.130959

converged

initial value -1.147318

iter 2 value -1.150711

iter 3 value -1.151405

iter 4 value -1.152442

iter 5 value -1.152564

iter 6 value -1.152573

iter 7 value -1.152574

iter 7 value -1.152574

iter 7 value -1.152574

final value -1.152574

converged

<><><><><><><><><><><><><><>

Coefficients:

Estimate SE t.value p.value

ma1 -0.3678 0.0359 -10.2365 0.0000

ma2 -0.0704 0.0354 -1.9911 0.0468

sma1 -0.8651 0.0182 -47.4548 0.0000

sigma^2 estimated as 0.09759346 on 765 degrees of freedom

AIC = 0.5431467 AICc = 0.5431876 BIC = 0.5673331

initial value -0.827261

iter 2 value -1.034332

iter 3 value -1.066295

iter 4 value -1.094823

iter 5 value -1.108013

iter 6 value -1.115246

iter 7 value -1.116173

iter 8 value -1.120248

iter 9 value -1.120892

iter 10 value -1.121657

iter 11 value -1.122186

iter 12 value -1.124590

iter 13 value -1.125269

iter 14 value -1.125654

iter 15 value -1.125685

iter 16 value -1.125685

iter 17 value -1.125687

iter 18 value -1.125689

iter 19 value -1.125689

iter 20 value -1.125689

iter 20 value -1.125689

iter 20 value -1.125689

final value -1.125689

converged

initial value -1.146682

iter 2 value -1.150731

iter 3 value -1.152123

iter 4 value -1.152815

iter 5 value -1.153157

iter 6 value -1.153220

iter 7 value -1.153266

iter 8 value -1.153337

iter 9 value -1.153352

iter 10 value -1.153359

iter 11 value -1.153384

iter 12 value -1.153388

iter 13 value -1.153390

iter 14 value -1.153390

iter 14 value -1.153390

iter 14 value -1.153390

final value -1.153390

converged

<><><><><><><><><><><><><><>

Coefficients:

Estimate SE t.value p.value

ar1 0.2203 0.0894 2.4660 0.0139

ma1 -0.5797 0.0753 -7.7029 0.0000

sma1 -0.8656 0.0182 -47.5947 0.0000

sigma^2 estimated as 0.09742764 on 765 degrees of freedom

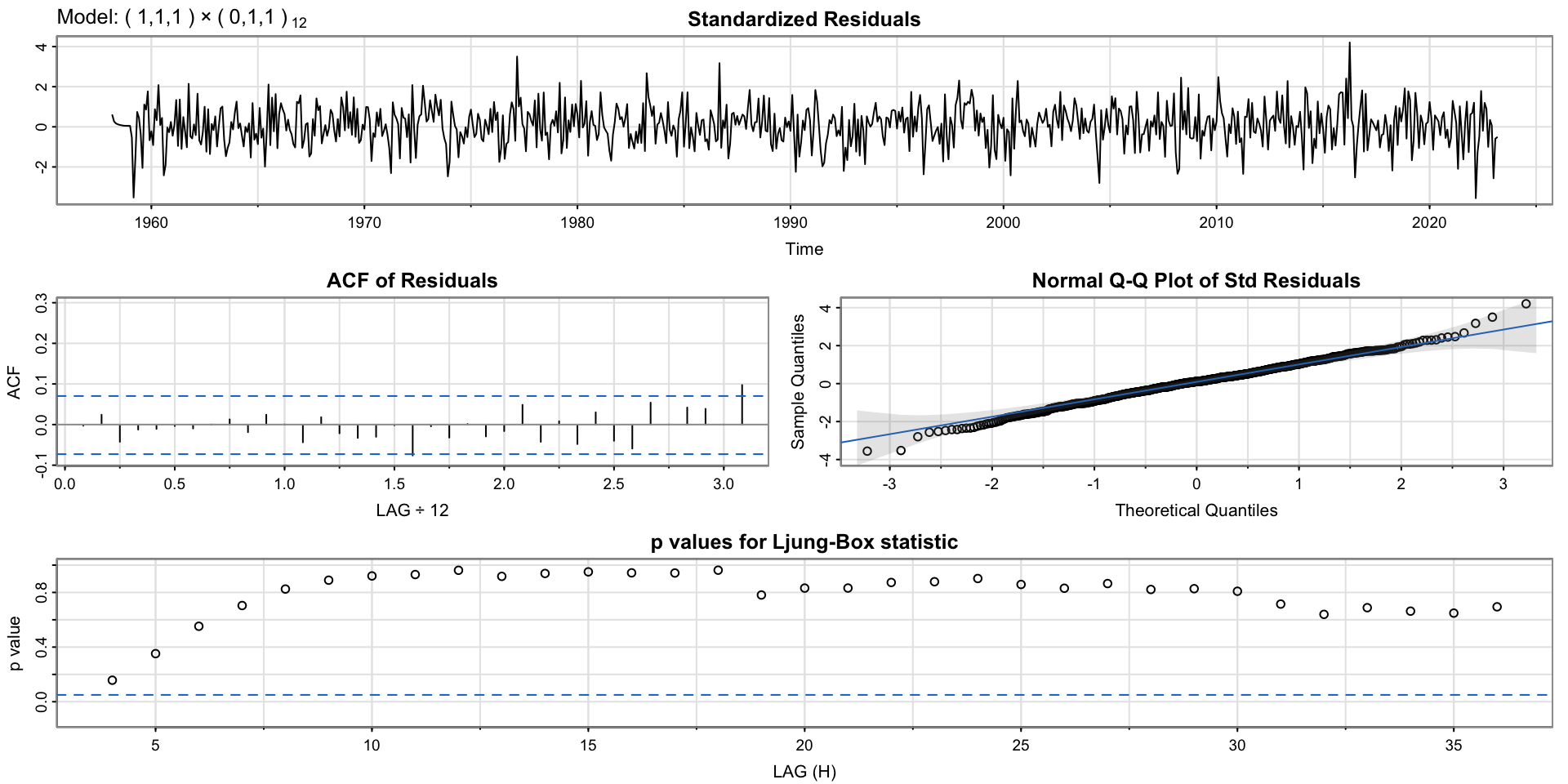

AIC = 0.541514 AICc = 0.5415549 BIC = 0.5657004

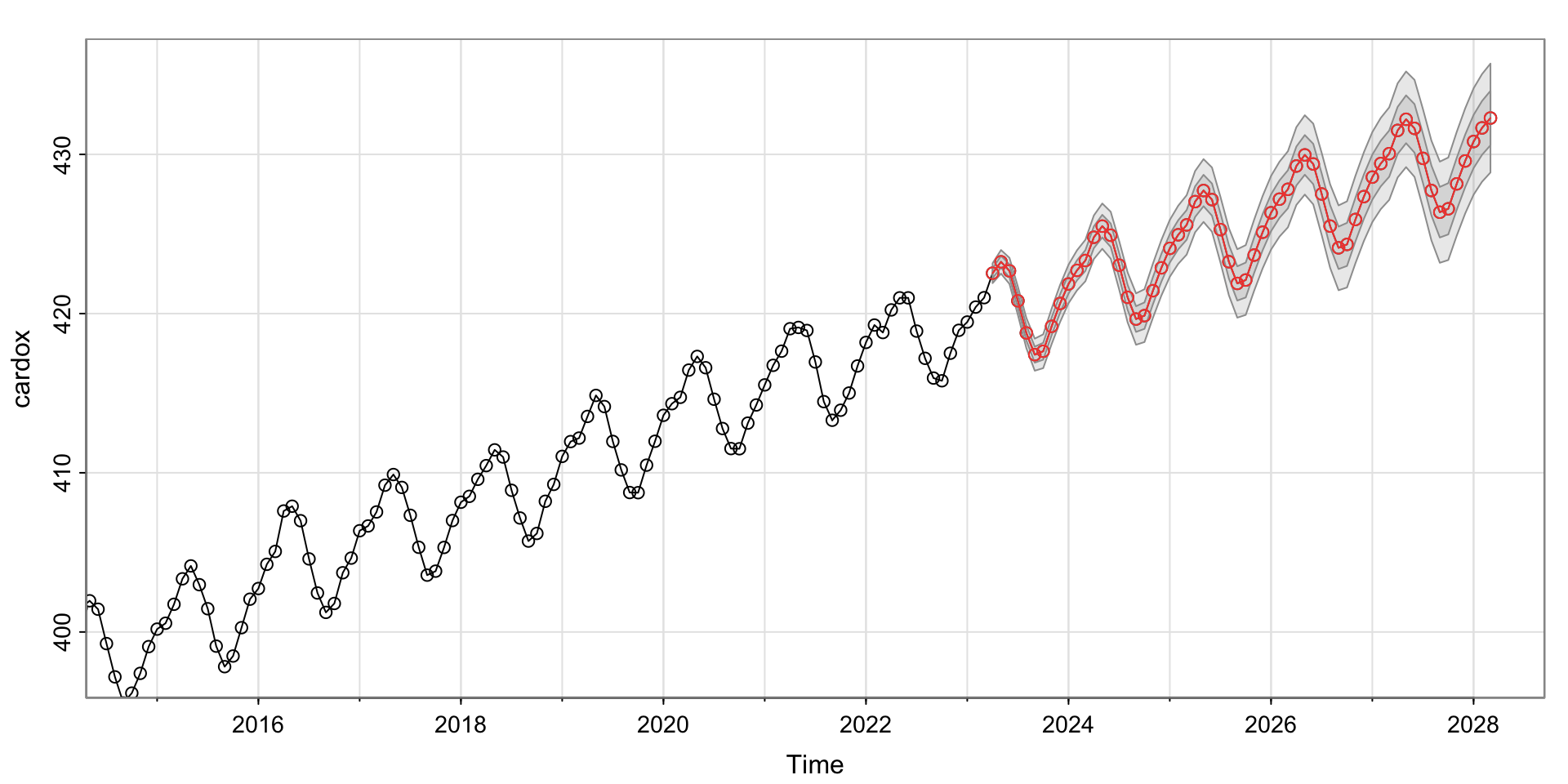

Forecasting

Looks like we predict the \(CO_2\) to continue to increase…

$pred

Jan Feb Mar Apr May Jun Jul Aug

2023 422.5365 423.2516 422.6841 420.8017 418.7844

2024 421.8604 422.7144 423.3343 424.7951 425.4936 424.9223 423.0392 421.0216

2025 424.0976 424.9517 425.5715 427.0323 427.7308 427.1595 425.2764 423.2588

2026 426.3348 427.1889 427.8088 429.2695 429.9680 429.3968 427.5136 425.4961

2027 428.5720 429.4261 430.0460 431.5067 432.2052 431.6340 429.7509 427.7333

2028 430.8092 431.6633 432.2832

Sep Oct Nov Dec

2023 417.4195 417.6341 419.1994 420.6362

2024 419.6567 419.8713 421.4367 422.8734

2025 421.8940 422.1085 423.6739 425.1106

2026 424.1312 424.3458 425.9111 427.3479

2027 426.3684 426.5830 428.1483 429.5851

2028

$se

Jan Feb Mar Apr May Jun Jul

2023 0.3121340 0.3706892 0.4100237 0.4437896

2024 0.6057658 0.6286983 0.6508233 0.6839230 0.7112115 0.7366194 0.7609956

2025 0.8931404 0.9133056 0.9330350 0.9616380 0.9859772 1.0090191 1.0313946

2026 1.1563743 1.1759118 1.1951299 1.2221148 1.2455209 1.2678703 1.2896982

2027 1.4134077 1.4329864 1.4523012 1.4786701 1.5018653 1.5241385 1.5459682

2028 1.6707850 1.6906907 1.7103647

Aug Sep Oct Nov Dec

2023 0.4747345 0.5036938 0.5310578 0.5570754 0.5819301

2024 0.7845756 0.8074590 0.8297096 0.8513785 0.8725094

2025 1.0532622 1.0746779 1.0956735 1.1162740 1.1365011

2026 1.3111337 1.3322181 1.3529726 1.3734132 1.3935539

2027 1.5674673 1.5886697 1.6095915 1.6302447 1.6506393

2028 $pred

Jan Feb Mar Apr May Jun Jul Aug

2023 422.5365 423.2516 422.6841 420.8017 418.7844

2024 421.8604 422.7144 423.3343 424.7951 425.4936 424.9223 423.0392 421.0216

2025 424.0976 424.9517 425.5715 427.0323 427.7308 427.1595 425.2764 423.2588

2026 426.3348 427.1889 427.8088 429.2695 429.9680 429.3968 427.5136 425.4961

2027 428.5720 429.4261 430.0460 431.5067 432.2052 431.6340 429.7509 427.7333

2028 430.8092 431.6633 432.2832

Sep Oct Nov Dec

2023 417.4195 417.6341 419.1994 420.6362

2024 419.6567 419.8713 421.4367 422.8734

2025 421.8940 422.1085 423.6739 425.1106

2026 424.1312 424.3458 425.9111 427.3479

2027 426.3684 426.5830 428.1483 429.5851

2028

$se

Jan Feb Mar Apr May Jun Jul

2023 0.3121340 0.3706892 0.4100237 0.4437896

2024 0.6057658 0.6286983 0.6508233 0.6839230 0.7112115 0.7366194 0.7609956

2025 0.8931404 0.9133056 0.9330350 0.9616380 0.9859772 1.0090191 1.0313946

2026 1.1563743 1.1759118 1.1951299 1.2221148 1.2455209 1.2678703 1.2896982

2027 1.4134077 1.4329864 1.4523012 1.4786701 1.5018653 1.5241385 1.5459682

2028 1.6707850 1.6906907 1.7103647

Aug Sep Oct Nov Dec

2023 0.4747345 0.5036938 0.5310578 0.5570754 0.5819301

2024 0.7845756 0.8074590 0.8297096 0.8513785 0.8725094

2025 1.0532622 1.0746779 1.0956735 1.1162740 1.1365011

2026 1.3111337 1.3322181 1.3529726 1.3734132 1.3935539

2027 1.5674673 1.5886697 1.6095915 1.6302447 1.6506393

2028

Compare to auto arima

May be overparameterized…

Series: value

Model: ARIMA(1,1,1)(2,1,2)[12]

Coefficients:

ar1 ma1 sar1 sar2 sma1 sma2

0.2219 -0.5821 -0.3132 -0.0169 -0.5481 -0.2724

s.e. 0.0891 0.0749 1.4611 0.0421 1.4610 1.2649

sigma^2 estimated as 0.09985: log likelihood=-203.82

AIC=421.65 AICc=421.79 BIC=454.15